How to establish personal financial goals.

SETTING FINANCIAL GOALS

Personal financial goals are intentions to use financial resources in the future. They are established and clarified early in the financial planning process, as the necessary financial documents are gathered and the current financial situation is detailed. The process of establishing and clarifying financial goals gets families on the same page and often clarifies formerly vague aspirations.

The financial goals will soon be specific, measurable, achievable, relevant, and time-bound (SMART). First, the extent to which the financial goals are achievable must be determined through the financial planning process. From there, financial goals are readily adjusted in accordance with an evolving financial reality.

All financial goals have a similar set of parameters. Financial goals have target dollar values, target dates at which they will occur in the future, a duration of years over which they require resources to fund, and a frequency that clarifies how often a goal will occur. Most financial goals are impacted by inflation and many require saving and investing to fund.

Common financial goals include establishing an emergency fund, paying off debt, purchasing vehicles, homes, and real estate, maintaining said homes and real estate, funding college, managing healthcare costs, affording retirement, and enjoying travel.

The financial planning process is essential to achieve financial success. Goal setting is a crucial early and ongoing step in that process. Goals help families work towards a financially secure future. Let’s get started on your financial journey to bring success home!

TARGET DOLLAR VALUE

Financial goals should target a specific dollar amount. The idea is usually to accumulate or preserve financial assets to fund future spending. In order to know how much of a family’s hard-earned resources to set aside for the future, at least a reasonable estimate of the cost of the future goal must be understood.

There are many ways to improve target dollar estimates for financial goals:

Research common goal amounts

Set goal amounts equal to future loan balances, perhaps informed by amortization schedules

Price-shop relevant markets

Get quotes

Discuss with family

Ask market experts

Explore industry data

Complete a cash flow statement

Consider the cost of previously completed related activities

Use online tools and calculators

BE AMBITIOUS

When initially setting financial goals, make them ambitious. Targeting insufficient resources for preferred and otherwise attainable financial goals is a recipe for unnecessary disappointment. An effective financial planning process will bring to light if the financial goals need to be made more modest. Give the process an opportunity to play out.

Stretch goals can provide motivation to work harder and achieve more than what might have originally seemed possible. Don’t get too carried away. Be boring. This shouldn’t be an exercise in excessive risk. It should be an exercise in motivation and discipline.

Celebrate small victories along the way. Did you get out of bed this morning? Well done! Now, just focus on taking that all-important next step.

TARGET DATES FOR FINANCIAL GOALS

Setting a target date for financial goals is a critically important activity of goal setting. Try to be ambitiously realistic. Consider factors such as your age and your income. A preferred retirement date may well be yesterday, but that may not be terribly realistic.

Confirming whether or not sufficient resources will be available to fund financial goals at some future date requires identifying a target date. Invested assets are expected to grow over time, or they wouldn’t be pursued as investments. Still, sufficient time will be required to allow investments to grow into the required resource.

Sometimes the target date will need to be adjusted. Life is unpredictable and unexpected expenses or changes in financial situation can impact the timeline. An effective financial planning process can accommodate changes on the ground and replace chaos and poor decision-making with informed and smooth transitions.

DURATION AND FREQUENCY

Some financial goals are not one-time events. They have duration and frequency characteristics, occurring over many years or every so often. The duration and frequency of financial goals can be adjusted to help make the financial planning process successful.

Annual travel and home maintenance, for example, may repeatedly tap resources for decades. Are there periods of life when travel is not necessary? If so, can other, potentially more important, goals be achieved with the freed-up resources? Most travelers naturally travel less later in life.

Goals can also occur at different frequencies. Some families choose to travel every other year. Vehicle purchases may occur every five to ten years. An effective financial planning process can readily dial in frequencies to make the most of financial tradeoffs.

PRIORITIZE FINANCIAL GOALS

Once all the financial goals are clarified, it is generally a good idea to prioritize the goals in order of importance. If there are some goals that cannot be achieved, it is good to know which ones are least important. Resources directed to the least important goals can be redirected, in part or in whole, to financial goals a family holds dearer.

Remain flexible. Financial goals and preferences evolve. At times, and quite naturally, a goal may require more or fewer resources than was targeted. In that case, more time or funds may be necessary to fulfill the goal, or resources may be freed up for other goals, depending on if reality was higher or lower than estimates. In either situation, the financial planning process will readily inform the evolving situation and provide a platform for effective ongoing decision-making.

Actively and routinely engage in the financial planning process to understand the whole picture and the impact one goal has on others. Decide if you are comfortable with that impact and remember to dance. Life is short. It can help to know the music.

INFLATION

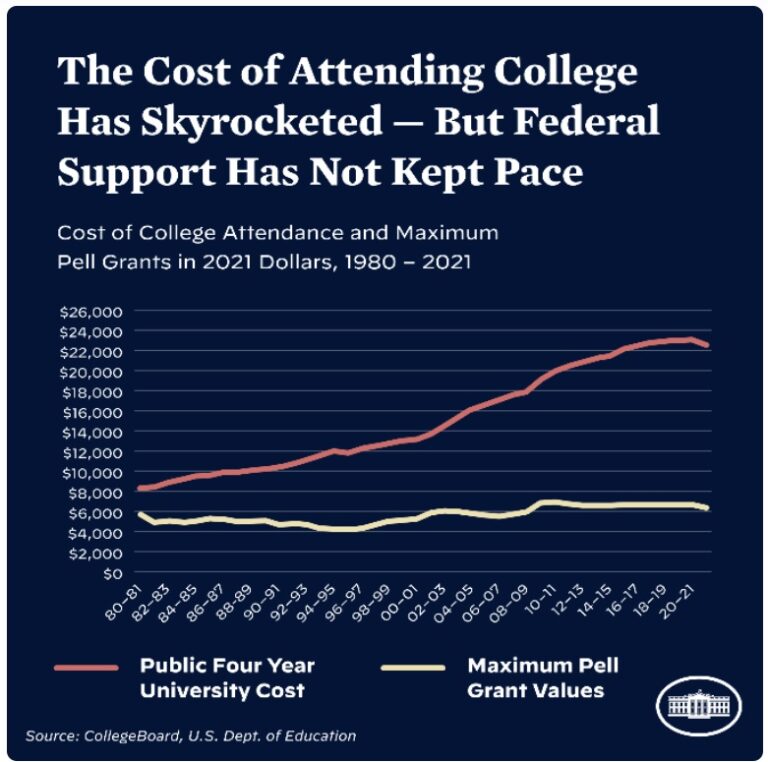

Many goals will grow with inflation. Vehicles and homes, for example, become more expensive over time. Some goals will grow faster than inflation. Healthcare and college costs have historically outpaced inflation.

Inflation plays a larger role in the financial planning process than most families appreciate. Give retirement lifestyle expenses decades of growth at inflation, or healthcare costs at greater than inflation, and what started as affordable could lead to penny-pinching midway through retirement.

If a loving couple retires prepared to afford $4,000 per month, will they be positioned to later in life afford an inflated $5,000 per month? Pinching pennies late in life, after a lifetime’s worth of work, is not a requirement. It is often the result of choosing to forego a proper financial planning process for decades.

SAVE MONEY AND INVEST

Financial goals are usually an indication that a family intends to spend at some future point with assets accumulated or preserved until that point. Financial planning pursued before retirement often involves a need to save money and invest. Financial planning pursued in retirement often involves preserving assets to cover spending until the end of life.

For these purposes, a cash flow statement can help to inform spending levels and facilitate regular monthly savings in pursuit of meaningful financial goals. By comparing inflows and outflows, families can identify areas where they may be overspending or where they could free up additional cash for savings.

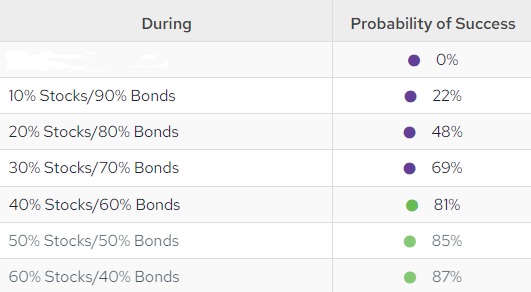

Of course, it is also important to consider what investment rates of return are needed to match resource and spending expectations. As progress is made, it’s important to keep investment strategies aligned with mid-term financial goals that are drawing nearer. This may involve adjusting the investment mix as the target date approaches, or rebalancing to ensure continued appropriateness. Remember to keep tax considerations in mind throughout.

EMERGENCY FUND FINANCIAL GOALS

Having an emergency fund often gets overlooked. Establishing an emergency fund should be a primary financial goal, and, when remembered, is often the first goal achieved.

Emergency funds are a pool of liquid resources made available to cover short-term needs. Those needs might include temporarily replacing income until it can be more permanently replaced or tending to high-cost, unexpected maintenance of vehicles or homes. Sickness can also trigger emergency fund spending.

Generally, emergency funds are accumulated in bank savings accounts or taxable investment accounts. Both of these account types can offer some growth of capital while providing access to funds, as needed.

Borrowing at unnecessarily high frequencies is a common symptom of insufficient emergency fund planning. Having an emergency fund can help to avoid going into debt or selling investments at a loss to cover these unexpected expenses.

Target twelve months of net employment income of the higher-paid spouse. Accumulate at least $20,000 of this amount in a bank savings account and the rest in a taxable brokerage account in conservative investments.

PAY OFF LOANS AND CREDIT CARD DEBT

Paying off loans and credit card debt is another common financial goal. Generally, high-interest-rate debt, like credit card debt, is the first target among loans. Credit card debt can sometimes be transferred to zero-interest rate credit cards long enough to reduce exorbitant interest costs.

Burdensome student loan debt is also a common scenario. In recent years, the battle over student loan debt has become increasingly political. Covid triggered student loan payment moratoriums. Before those were lifted, the Biden administration proposed a forgiveness plan, which triggered associated lawsuits, and then a new repayment plan.

Mortgages are often the largest liability on a balance sheet. They can be carried into retirement or paid off along the way. Many families just feel better knowing they do not need to pay a mortgage payment each month.

VEHICLES

Some families borrow to fund vehicle purchases. They tend to treat loan payments as a part of their cash flow goal. The cash flow statement can come in handy for identifying room in the budget.

Other families prefer to buy vehicles outright. They tend to establish related financial goals to make sure they are routinely positioned to cover this recurring expense. A married couple might set a recurring vehicle purchase every five years. For a family with two vehicles, this would mean each vehicle would be replaced every ten years.

When setting financial goals for vehicle purchases, remember to index the target dollar amount to inflation. According to the National Automobile Dealers Association (NADA), the average price of a new car sold in 1990 was $16,950. Today, the average price of a new car is $40,000!

When a mortgage is used to complete a home purchase, a financial goal might be to accumulate funds for a 20% down payment. This helps to avoid escrow and to receive more favorable financing terms. Then, each ongoing monthly payment might be a separate goal.

When homes are purchased without financing, the entire purchase amount is routinely a goal. If another home will be sold to help pay for the new home, the net proceeds from the sale would be earmarked to fund the new purchase.

If a home is sold to downsize living arrangements, capital may become available to fund other goals. Before committing to that conclusion, a family should consider the transaction costs of moving, there are many, and if any home equity lines of credit or second mortgages might reduce the net proceeds of the “downsize”.

HOME MAINTENANCE/IMPROVEMENT

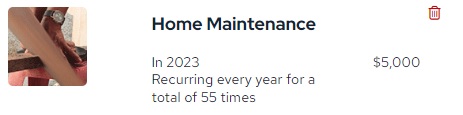

Every home requires maintenance. Oftentimes, families do not know what maintenance will come calling until they find themselves repairing what was working. Most families engaged in a proper financial planning process with a financial advisor will include a goal of a reasonable ($3,000 – $10,000) annual amount to cover this “unforeseen” expense. An emergency fund can also help to bridge any deficiencies with a home maintenance goal.

Home improvements of all sorts can additionally be their own financial goals. These items are known and anticipated. A family might want to finish their basement, build a deck, add a garage, or recarpet, among endless other options. Planning for home improvements helps to make sure the funds are available and that their cost will acceptably impact other goals.

We all want our house to be our castle, but there are likely other competing goals that could be agreeably more important. The financial planning process makes it possible to clearly evaluate these tradeoffs.

COLLEGE FINANCIAL GOALS

With children comes an important question. How much of their eventual college expense do moms and dads want to fund? There is no correct answer to the question, but the answer certainly can have significant consequences. Too much college funding could impact other goals, like retirement savings. Too little college funding could mean burdensome debt loads for the young graduate.

Working through the myriad of considerations, including 529 plans, student loans, FAFSAs, employed students, scholarships, college costs, and college choices, helps a family identify personal finance parameters that work for their situation and preferences. Factor in tuition costs that grow faster than inflation and this goal quickly becomes an impactful one for most families.

It’s important to establish realistic financial goals as early as possible. Some parents share their thoughts on college funding goals with their kids and some don’t. When discussing college financial goals with kids, parents should keep in mind the importance of being transparent and realistic about the extent to which they intend to fund this goal.

Parents should encourage kids to consider all of their options. If the resources made available for college are not used to fund college, some families preserve the funds for the children for other purposes and some do not. Again, there is no one correct answer.

Often, college represents the start of the lifelong financial journey for students. Parents can help their kids understand the long-term financial implications of taking on student loans, including the potential impact on their post-college financial goals such as buying a home or starting a family. Ultimately, the goal of discussing college financial goals with kids is to help them make informed decisions about their future while also ensuring that the family’s financial health is protected.

HEALTHCARE FINANCIAL GOALS

Affordable Care Act, Medicare, employer-sponsored health insurance, Medigap, Medicare Advantage, IRMAA, Health Savings Accounts, Cobra, prescription drug coverage, costs that grow faster than inflation, and decades’ worth of needs, oh my!

Yes, an effective financial planning process can synthesize and make sense of this mess. There is, somewhat obviously, a chronology to these coverage options. When taken step-by-step, they can each be handled in a responsible way that informs risk management and clarifies their impact on a family’s financial life.

In addition to planning for medical expenses, it’s important to consider the potential impact of long-term care needs on financial goals. Long-term care can be expensive and can quickly deplete savings. There are three funding options: insurance, personal assets, and Medicaid. None of those options are terrific.

Regular exercise, a healthy diet, and preventative care can all play a role in maintaining good health and potentially costly medical treatments down the road.

RETIREMENT PLANNING FINANCIAL GOALS

For various reasons and matters of preference, most people cannot work forever. Having a sense of what is possible in terms of timing and monthly spending amounts enables more options, from early retirement to mini-retirements to downsizing the income in order to upsize the hours spent away from work.

Retirement accounts, such as 401(k) plans, IRAs, and Roth IRAs, can help maximize resources and take advantage of potential tax benefits. From there, you can begin to develop a retirement savings plan that takes into account factors like inflation and expected investment portfolio returns.

Uncover the possibilities with retirement planning, or at least know when the grind can end! What needs to be accomplished to live the life you wish to live?

Caring.com is loaded with senior care resources, including money management tips.

TRAVEL FINANCIAL GOALS

Annual travel and bigger trips are common financial goals. While they can be great ways to make memories and explore new places, they also come with costs that can add up quickly.

Can you afford that trip to Hawaii you always wanted to take? What impact will it actually have on the other financial goals you wish to achieve?

BOATS AND TOYS

Want a yacht? That could cost a lot. Most folks don’t, but maybe you do. If you can dream it, there’s a financial goal for that.

For recreational toys, remember there are usually related expenses that stretch well beyond the initial purchase price. Ongoing maintenance, storage, insurance, and fuel costs may add up.

DIVORCE

While divorce can be a difficult and emotionally challenging process, it’s important to address the financial implications. Couples should work together to divide assets and property. Alimony and child support must also be factored in. Clearly, financial goals will be re-evaluated. By taking a thoughtful and strategic approach to the financial aspects of divorce, a stable and secure future can follow.

When couples find each other after having tried with someone else first, even if the ex-spouse is rather forgettable, the children from that relationship will forever be the world. Building a new life with a new spouse while maintaining children as beneficiaries can require careful planning. Still, solutions, agreements, and understanding are usually achievable.

LEGACY FINANCIAL GOALS

When much goes well, families can plan for a financial legacy. Whether it’s passing down assets to future generations or supporting a favorite charity, there are many ways to create a lasting impact. Understanding the varied options enables clear and cost-effective preferences to be adeptly carried out. With careful planning and consideration, families can create a financial legacy that aligns with their values and goals. After a life well lived, providing a secure financial future for loved ones is a lasting reward.

PERSONAL FINANCE FINANCIAL GOALS

Financial goals put the personal in personal finances. Every family has a financial plan whether they know it or not. Independent third parties regularly write informative articles to help families understand what factors to consider when choosing a financial advisor.

By taking the time to identify specific goals, determine financial resources, and set realistic timeframes, families can make meaningful progress toward their desired outcomes. You can confidently navigate the challenges and opportunities of life. Personal finance is about using resources to create the life you want to live.