Financial Planning Process: Family Guide

WHAT IS THE FINANCIAL PLANNING PROCESS?

For FinancialFamilies, the financial planning process leads to identifying attainable financial goals through a series of interrelated activities. Common sense, financial tools, and financial planner experience inform the process.

DATA GATHERING

Data gathering, including gathering up your financial documents, is the first of several interrelated activities of the financial planning process. As you might imagine, data gathering for a family’s entire financial life is a bit involved. Accounts of every type, including bank, employer, and personal must be well understood and detailed. Balances, holdings, contribution rates, employer match formulas, and cost basis all play a role.

Business interests should be understood and valued. Real estate and significant personal property are inventoried.

Pension and Social Security benefits are calculated across a range of retirement and commencement ages. Liabilities are amortized. Life, health, disability, long-term care, auto, home, and umbrella insurance coverage are detailed.

Cashflow expenditures are carefully categorized and adjusted for retirement expectations. Paystubs and tax returns are reviewed for improved opportunities. Estate plans are summarized.

Data gathering is a critical first step. Financial advisors are adept at pulling together the required information. They have seen it all before and can readily distinguish the wheat from the chaff.

If documents are not readily available, financial planners generally know various ways to help families attain the required information. After all, accurate and complete information set the stage for further analysis of financial goals.

GOAL SETTING

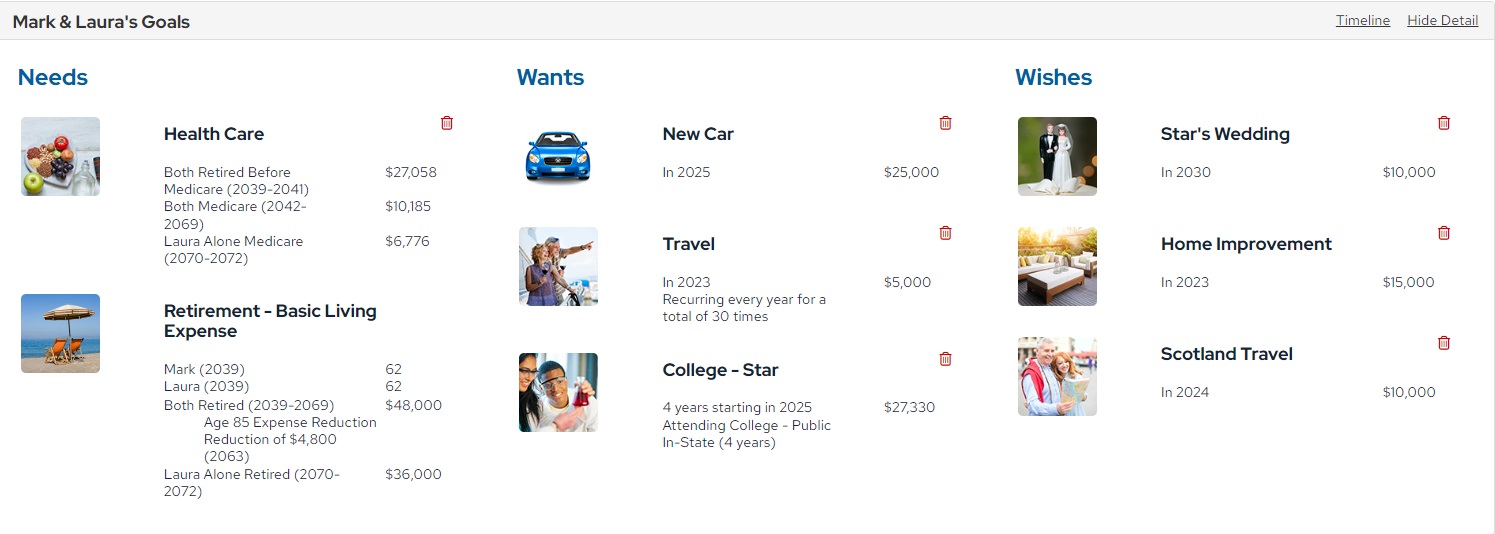

Loving families work hard for a lifetime to accumulate the assets required to fund the financial goals they wish to enjoy. Clarifying the goals is critical for understanding what resources and how much flexibility for life choices will be required and available.

Two goals with enormous impact are healthcare and retirement lifestyle expenses. Retirement lifestyle expenses are funded for several decades and grow with inflation throughout the entirety of the planning period (for life).

To clarify anticipated retirement lifestyle expenses, cash flow is carefully examined and adjusted for expenses that will not continue into retirement, like investment contributions and loan payments.

Other common goals, often with unique timeframes, include home maintenance, home improvements, and travel. College expenses, weddings, second homes, and the selling and buying of real estate also regularly factor into financial plans for FinancialFamilies.

RESOURCE IDENTIFICATION

Families utilize various resources to fund their financial goals. Believe it or not, despite dwindling numbers, plenty of employers still offer pensions for their employees. Pensions have formulas that describe payment amounts. Those benefit formulas depend on factors like years of service, earnings, and commencement ages.

Pension benefits should be regularly and carefully recalculated as benefit estimates change over time. Oftentimes, families think their pension benefits serve as the obvious answer to all potential questions regarding their financial future. Nothing could be further from the truth. A pension, like any other resource, can be insufficient to fund preferred and otherwise attainable goals.

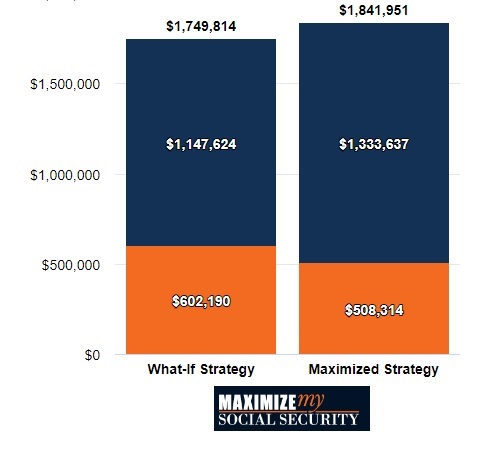

Social Security benefits are akin to pensions. All that is true for understanding pensions is also true for understanding Social Security. Social Security benefits often have a more meaningful impact on financial planning than is appreciated.

Spousal and widow Social Security benefits can be impacted by Government Pension Offset and Windfall Elimination provisions. For all these reasons, Social Security considerations require forethought and diligence.

Investment accounts, including employer-sponsored retirement plans, individual retirement accounts, and those personally held, are often thought of as the sole focus for most financial planners. In reality, high-functioning fiduciary financial planners consider, review, and analyze investment accounts as just one important resource among a collection of important resources.

CASHFLOW

Plenty of families begin their relationship with the financial planning process to manage cash flow. Some families are considering shifts in employment. Others might have finally generated an income that exceeds their appetite to spend.

Temporary cash flow squeezes occur for any number of reasons, from health to home repairs. Whatever the circumstance, cashflow considerations always play a critical role in buttoned-up financial planning.

What is the expense picture today? What lifestyle is preferred and attainable in the future? For how long can available resources fund a preferred lifestyle? These are among critical questions that help determine the resources families endeavor to accumulate to fund their financial goals.

INVESTMENT CONTRIBUTIONS

Saving and investing are activities families pursue to accumulate the resources they require. How much investment is necessary? To what extent is further investment immediately affordable? What impact will additional investment have on your financial planning? How should investment contributions be allocated among the available investment account types? These are all important considerations a financial planner explores along the way to refining and deploying financial plans.

ASSET ALLOCATION

Once a family accumulates value in their investment accounts, investment management decisions are required. How exactly should an investment portfolio be constructed? Should stocks and bonds be deployed? How much of each should be held in the portfolio? Is the risk tolerance sufficient to own the investments that may best position resources for the long term? How much return is needed anyhow? Does a 1% difference in annual returns in a portfolio over a lifetime make a squat of difference?

A family can answer these questions alone, with help, or without paying them any attention whatsoever. Families that work with a financial planner seek to answer these questions confidently and with proper information and guidance.

REAL ESTATE AND OTHER ASSETS

Families own real estate. Real estate, whether a primary residence or other forms, can have expense, income, asset, and liability implications.

Some families own all sorts of stuff, including precious metals, artwork, antiques, and automobiles. They want to know how best to manage this ownership for the betterment of their financial lives, while sometimes enjoying the assets they have accumulated.

INSURANCE

Permanent life insurance policies, often purchased before working with a qualified fiduciary financial planner, have cash value and surrender implications that must be thoroughly understood, confirmed, and managed.

Furthermore, every insurance policy, including term life, health, disability, long-term care, and property and casualty insurance (think auto and home), materially impact a financial plan’s ability to serve its masters in times of hardship.

It’s well and good to accumulate a fortune. If that fortune is resting on shaky ground, it’s not truly a fortune. Loads of famous folks have put on airs to later discover shortcomings in their approach to risk management.

EMPLOYER STOCK

Some corporate executives have employer stock incentives, like restricted stock and stock options. Those benefits can have an outsized impact and should be carefully incorporated into the financial planning process.

Most everyone now knows concentrated stock positions are a risk. Moving away from a concentrated position in employer stock requires a financial advisor to understand the administrative intricacies and unique tax ramifications.

LIABILITIES

Most often, liabilities take the form of mortgages, student loans, auto loans, and credit cards. Occasionally, high-income families have burdensome debt from student loans. Those debt burdens tend to be a considerable short-term obstacle that weighs heavily on the client’s personal cash flow.

Usually, putting that burden in the context of an otherwise successful lifelong financial plan brings some level of relief to the family. Debt management then becomes a surmountable temporary condition within the context of a successful lifelong financial plan that can be designed for favorable lifelong outcomes.

With a clear understanding of what a family owns, owes, earns, and spends, sophisticated financial planning software can help inform the sanity of it all. Monte Carlo simulations, generally speaking, use repeated random sampling to produce a range of results. For financial planning purposes, Monte Carlo simulations randomize portfolio returns over thousands of lifetimes to help a financial planner better understand the range of likely outcomes for a family’s mix of goals and resources.

In essence, the financial planning process indicates the likelihood that a collection of resources can be reasonably expected to fund a collection of goals. If a family’s resources are highly likely to fund their goals, then they know they are making sense of and progressing with their financial lives. They have an informed, preferred, and attainable mix of goals and resources.

From there, a financial planner can better understand the impacts of economic and personal factors, capture available opportunities, and help navigate a dynamic world full of surprises. In short, the family goes from winging it to owning it.

FINANCIAL PLAN

With the financial planning process complete, a family can identify and record the salient points in a written financial plan. The financial plan includes clearly stated goals, broad activities that conceptually describe the pursuit of those goals over a lifetime, and specific action steps to implement over the next year to improve a client’s current financial situation.

Of course, financial plans aren’t written in stone. They should be regularly reviewed and adjusted to account for changes on the ground. As with planning for an army, the financial planning process continuously informs a reasonable and forward-moving direction, especially in a dynamic environment.

FINANCIAL PLANNER

Armies do not carve plans in stone and follow them without consideration for the evolving situation. The same should be said for the financial planning process. As values, goals, preferences, and many other factors evolve, the financial planning process informs the journey. Families who do not engage in the financial planning process inevitably end up with an uninformed mess of a situation that requires unnecessary sacrifices to relieve. Financial planners are all too accustomed to hearing, “we should have come to you a long time ago.”

FINANCIAL PLANNING RECOMMENDATIONS

Every family has a financial plan, whether they know it or not. The financial planning process informs financial planning recommendations. Frankly, the process of planning makes all the difference in the world for achieving a client’s personal and financial goals. Compromise elsewhere.