Financial Documents

WHAT FINANCIAL DOCUMENTS WILL BE NEEDED FOR FINANCIAL PLANNING?

A conscientious financial planning process depends on gathering a wide range of financial information from financial documents. Financial documents are full of financial details that must be well managed to make the most of a family’s lifetime worth of hard work.

Among the many financial statements, bank statements contain transaction details for cash flow analysis. Investment account statements, from employer-sponsored retirement plans to personally-held accounts, document investment assets.

Pension calculations specify future income statement expectations. Social Security earnings histories determine Social Security benefits. These financial documents provide the details for what is often the foundational resource for funding retirement living expenses.

Paystubs contain gross wages, deductible employee expenses, employer benefits, tax withholdings, and net income. Paystubs are financial documents that clarify the bulk of current income for most families.

Loan documents contain interest rates, terms, and payment amounts. Insurance policies and declaration pages clarify coverage.

Estate plans should be current and clearly describe the family’s wishes.

In short, the first step of the financial planning process is to gather all related financial documents. Ultimately, your family needs to know, in detail, what you own, owe, earn, and spend, and have a good sense for how those categories will change over time.

UNDERSTANDING FINANCIAL STATEMENTS

While financial statements cover a wide range of topics, they do share some common characteristics. Here is a brief mention of a few common features for most financial documents:

Dates: Always start with the date. Most of the time, a document dated within the most recent year or two is going to be required.

Contact Information: Most financial statements also contain contact information. If more documents are needed, the contact information on the statement is a great place to start.

Page Numbers: Pay attention to page numbering. Are any pages missing?

BANK STATEMENTS

Among specific financial statements, bank statements provide key information about a family’s basic bank accounts. How much liquidity is available at the bank? Are there a sensible number of bank accounts? Should any accounts be consolidated?

Bank statements also contain transaction detail for the cash flow statement. A family benefits from having some basic idea of where they spend their money. Ultimately, this information informs the retirement lifestyle cash flow goal, which is an enormously impactful goal.

Bank accounts lay the foundation as one of many assets on a family’s balance sheet. With any luck, they hint at positive cash flow that can be put to better use through investing activities or to further fund debt payments. Bank statements are one of the more common financial documents.

CREDIT CARD FINANCIAL DOCUMENTS

Similar to bank statements, credit card statements are also financial statements that include transaction detail for the cash flow statement. Minimum payment amounts, interest rates, and balances are found in credit card statements.

It is important to regularly review credit card statements to stay on top of spending patterns and ensure that all charges are accurate. In addition, credit card statements provide a good opportunity to review and monitor credit card usage, helping to avoid overspending and keeping credit card balances in check for healthy financial position.

By paying attention to the details in credit card statements, families can identify any suspicious or fraudulent activity and take action to dispute these charges with the issuer. It’s also important to check for errors, such as amounts or unfamiliar merchant names, as these can impact credit scores and financial stability.

Furthermore, credit card statements are crucial for building cash flow statements. By tracking spending habits and monitoring interest rates and balance changes, families can make informed decisions about how best to use their credit cards. This can help to achieve short-term and long-term financial goals.

INVESTMENT ACCOUNT STATEMENTS

Investment account statements are financial statements that list balances, holdings, and cost basis for any taxable accounts. They also should clarify fees and other activities, like dividend payments.

Investment account statements play a key role in monitoring and evaluating the performance of a family’s investments. By regularly reviewing these financial statements, families can track their investment portfolio’s growth and make informed decisions about their investment strategy.

In addition to providing an overview of investment holdings and balances, investment account financial statements also show gains, losses, or changes in cost basis for investments. This information is used for tax purposes and can help families plan for their tax liability.

Moreover, investment account statements can help identify fees, such as management fees and commissions, which can impact returns as they further inform a family of the many ways financial institutions are not working for free! Investment statements should detail well-considered investments aligned with a family’s goals and not excessive fees.

Finally, by tracking performance over time, families can assess the risk and return of their investments and make adjustments to their portfolio as needed. This can help support a successful investment strategy.

REAL ESTATE FINANCIAL DOCUMENTS

Oftentimes, county auditor websites provide important information. Tax payments, current ownership, and sales histories are available to inform the financial planning process.

Real estate usually plays a large role on a family balance sheet. Not only does it tend to be one of the largest assets but it can also have an associated mortgage, which is one of the largest liabilities on most family balance sheets.

Websites, like www.zillow.com, can help to develop a better sense of the current value of a home, even if a home is ultimately worth what someone is willing to pay for it.

Most pension plans have calculators available online to project future payments. The calculators depend on several factors, like work and salary history, dates of birth, and expected retirement and payment start ages. These calculations should be rerun regularly to provide an up-to-date sense of their impact on long-term financial position. This can help families make informed decisions and ensure that their financial goals and retirement plans are aligned.

Pensions are detailed in financial documents called a summary plan description. This document includes the pension formula that controls how the pension benefits are calculated. Understanding the formula can be quite useful for making the most of the plan.

With pensions, it is also important to keep in mind the company’s financial health. Have they adequately funded the pension? Might they?

SOCIAL SECURITY FINANCIAL DOCUMENTS

The Social Security Administration encourages workers to create an online account. The online account contains an earnings history. It is a good idea to regularly check the earnings history information to ensure that it is accurate.

The salary history informs the benefit amount. With a base benefit amount, known as the primary insurance amount (PIA), it is possible to select a start age to begin receiving this benefit that will help make the most from all those taxes paid over the years! Starting benefits before full retirement age can result in a permanent reduction in benefits while delaying benefits past full retirement age can increase benefits.

Social Security benefits can be impacted by changes in the law, such as changes to the full retirement age or the calculation of benefits. It is important to stay informed about these changes and how they may impact Social Security benefits.

LIABILITIES

It is important to gather all loan and mortgage financial documents, including loan statements and amortization schedules, to have a complete understanding of liabilities. By having this information at hand, a family can track progress and make adjustments to their financial position. Loan document financial statements detail interest rates, start and end dates, payment amounts, terms of years, and balances. They also note any prepayment penalties.

Amortization schedules show the progress of a loan over time. They can be produced for any liability, from a bank loan to a student loan. This financial statement helps to inform a proper course of action for the future, from refinance to early payoff.

Regularly reviewing and monitoring liabilities can help to stay on top of payments, reduce debt, and make informed decisions.

INSURANCE FINANCIAL DOCUMENTS

Insurance policy financial statements include policy pages, account statements, and declaration pages.

Policy pages detail the terms of coverage. Life, disability, health, long-term care, auto, and home insurance all play a big role in making sure a family can afford their future.

Three types of life insurance are permanent, term, and group. Permanent life costs more and builds cash value, which can be used in several ways. Term life provides coverage for several years. Group life provides coverage while employed. All have beneficiary designations. A permanent life insurance financial statement shows planned premium payments, cash value, surrender fees, and death benefit amounts. Permanent life often needs to be reviewed to make sure it will serve its purpose in the future using in-force illustrations.

Disability insurance can be purchased individually or through employment. Document details for disability insurance include length and amount of coverage and the definition of disability in the policy.

Throughout life, there are several health insurance types. Individual, group, and Medicare are among the most common. More and more, individual policies are purchased through an Affordable Care Act exchange. The plans found there are tiered Bronze, Silver, Gold, and Platinum. Cobra, Medicare Advantage, and Medigap are additional options to keep in mind as retirement healthcare is explored.

Declaration and policy pages contain detail for auto and home insurance. Coverage includes liability, medical, repair, and many other categories.

Be aware of the insurance company’s financial health. Can they afford to pay the coverage they promised? The insurance company’s financial position supports the financial strength of the family.

FINANCIAL DOCUMENTS FOR CASH FLOW STATEMENTS

Bank and credit card financial statements are categorized into cash flow statements. Groceries, merchandise, utilities, auto, home, travel, medical, and insurance costs are typical categories in a cash flow statement. It is important to identify those cash flow statement expenses that will continue into retirement. Cash flow goals tend to be among the largest and most important. Your cash flow statement is key to getting them right.

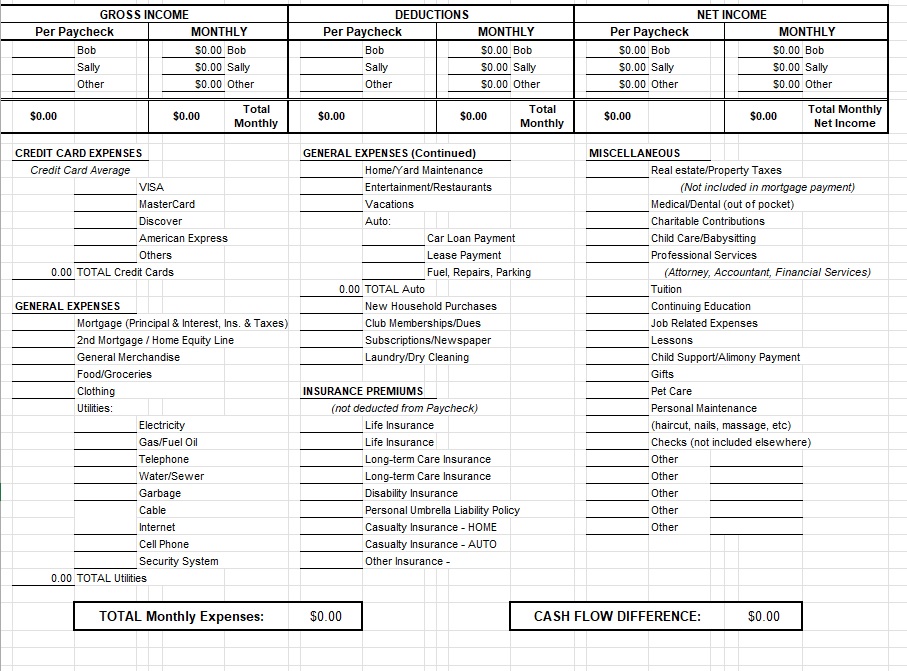

EXAMPLE OF A CASH FLOW STATEMENT

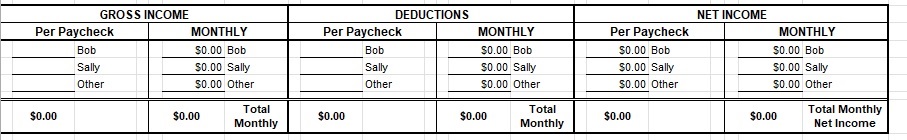

Here is an example of a cash flow statement that can be used to easily and quickly think through family expenses. It also includes an income statement.

Income statements are included within cash flow statements. Paystubs, rental income, and other recurring income inform the income statement component of a cash flow statement and provide fuel for financial growth. Gross pay, deductions, and net income are noted in an income statement. The net difference between the income noted on an income statement and the expenses of a cash flow statement shows to what extent a family can invest or may need to adjust their lifestyle.

PAYSTUBS

Paystubs are full of good information for an income statement. Gross pay, employee deductions, employer benefits, tax withholding, and net income all play a part in wealth building. Be careful when adding paystub information to the income statement of a cash flow statement. Depending on the employer, paystubs are paid monthly, every other week, or twice per month.

In addition to regular paystubs, it is important to also track bonuses and commissions. This information helps to build a comprehensive income statement. Often, net income from bonuses and commission payments is available for investment.

TAX RETURNS

Tax returns compile data from several financial statements to show income sources, deductions, tax liabilities, withholding, and refunds or amounts owed. Oftentimes, there are multiple tax schedules or reports.

Those schedules and reports show investment gains and losses, interest income, and other taxable income sources. They can also provide key information on deductions and credits claimed.

Tax projections help to manage this cost, especially as employment income gives way to retirement income.

Understanding your tax return can help to create a more accurate financial picture and to identify areas where adjustments can be made to reduce future tax liabilities. It is also a good idea to keep copies of tax returns on hand for several years in case of an audit. A financial planner can help you keep all this information readily available.

ESTATE PLAN DOCUMENTS

Last Wills, Trusts, Living Wills, and Powers of Attorney are common estate planning documents that detail the wishes of the family and help to keep the peace among those who remain. Beneficiary designations and property titles should also be included in the estate plan. Burial arrangements made while alive are appreciated by those who remain. Sometimes, estate plans include long-term care plans. If a family includes minor children, it is critical to appoint guardians.

If the estate plan is more than ten years old, blow the dust off. It is in desperate need of review, especially as life circumstances change. Estate plans should reflect current wishes and intentions. Having an up-to-date and comprehensive estate plan in place can provide peace of mind and help to make sure assets are managed and distributed as intended.

MISSING INFORMATION

Often, families cannot produce all of the many financial statements required for planning. A missing financial statement can lead to gaps in financial planning and missed opportunities for any balance sheet. Fiduciary financial planners can help obtain the missing information and organize all of the documents to keep them readily available going forward.

PULLING IT ALL TOGETHER

With financial statements in hand, all the details are pulled together for analysis and presentation. Every family has a financial plan, whether they know it or not. Knowing it is an entirely different experience. Work with a fiduciary financial planner who has seen it all before and can help you find value in the mountain of details.